|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

The Ultimate Guide to Online Home Refinance OptionsUnderstanding Online Home RefinanceOnline home refinance allows homeowners to replace their existing mortgage with a new one, often with better terms. This process can help reduce monthly payments, shorten loan terms, or access home equity. Benefits of Refinancing Online

Things to Consider Before Refinancing

How to Start the Online Refinance ProcessStarting the online refinance process is straightforward. Begin by gathering your financial documents, including your current mortgage statement, tax returns, and income verification. Finding the Right LenderResearch various lenders to find the one that offers the best terms for your situation. Consider exploring va mortgage streamline refinance options if you are eligible, as they may provide competitive terms. Application and ApprovalFill out the online application with accurate information. Once submitted, the lender will review your details and may request additional documents. If approved, you'll receive a new loan offer. Tips for a Successful Online Refinance

For those considering the current va mortgage streamline refinance rates, staying informed on market trends can be beneficial. FAQ: Online Home RefinanceWhat is the main advantage of refinancing online?The primary advantage is convenience, as it allows homeowners to compare and apply for refinancing options without leaving their homes. How do I know if I'm eligible for online refinancing?Eligibility depends on factors like your credit score, income, and the equity in your home. Checking these against lender requirements is a good first step. Are there any risks associated with online refinancing?While online refinancing is generally safe, it's important to use reputable lenders and ensure secure transmission of personal information. Can I refinance if I have a VA loan?Yes, veterans can explore options like the VA mortgage streamline refinance, which can offer unique benefits for eligible borrowers. https://www.communityamerica.com/personal/borrow/loans-and-credit-cards/mortgages/refinance

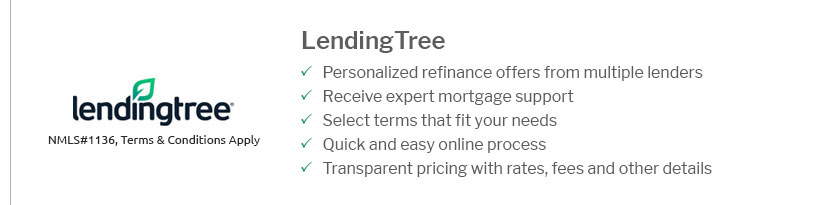

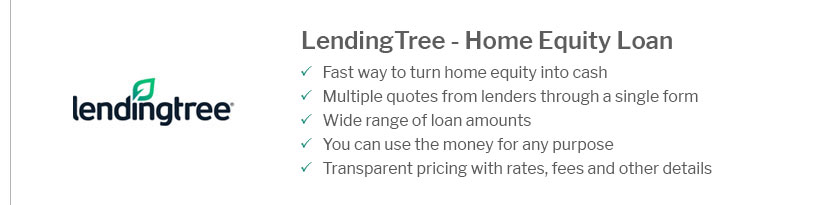

We're here to make finding the best mortgage rate for you as easy and convenient as possible. Simply enter your information in our handy online tool to check ... https://www.lendingtree.com/home/refinance/

Best refinance lender overall: Rate - Best online mortgage refinance experience from a traditional bank: Chase - Best for online refinance rate transparency: ... https://www.flagstar.com/personal/borrow/home-loans/refinance.html

Ready to apply online? Start your loan application here. Don't worryif you get stuck, we're just a phone call away.

|

|---|